Will Writing India: Why 40% of Will Queries Now Come from People Under 40

The landscape of estate planning in India has fundamentally shifted. What was once the domain of elderly grandparents has become a priority for young professionals in their 30s and 40s. With online will writing India platforms booming and digital will maker tools becoming household necessities, a new generation is taking control of their legacy planning.

The Millennial Estate Planning Revolution

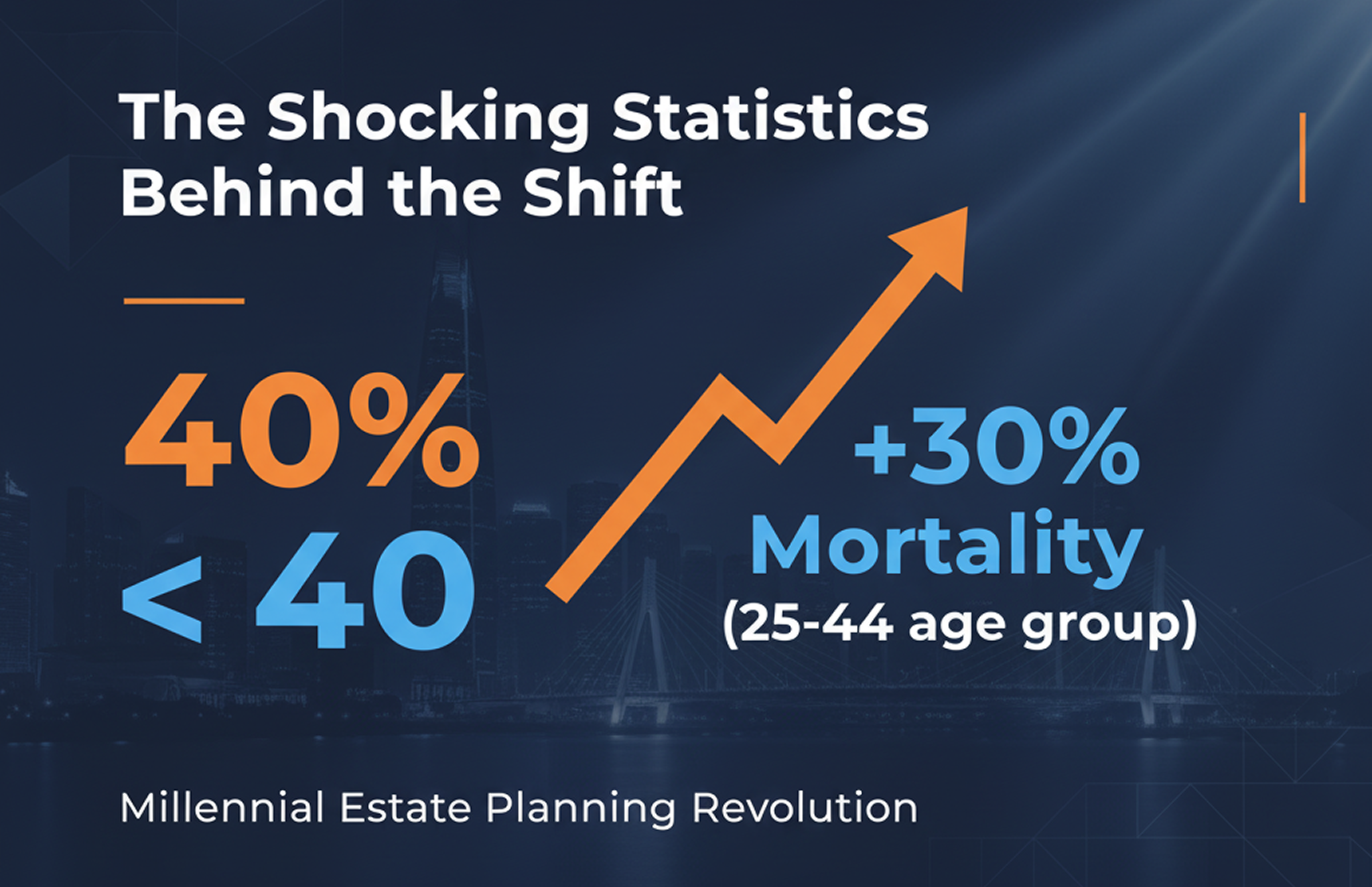

The Shocking Statistics Behind the Shift

The numbers tell a compelling story of changing attitudes toward estate planning in India. Over 40% of will writing queries now come from people below 40 years of age, representing a dramatic shift from traditional patterns where will writing was primarily associated with older adults.[1][2]

Key drivers behind this unprecedented surge:[3][2][1]

- Mortality in the younger age group (25-44) has increased by 30% compared to the overall 17% increase across all age groups

- Post-pandemic mortality awareness has made life's uncertainty real for young professionals

- Families are largely completed by age 35-40, with first homes, cars, and substantial savings in place

- The democratization of will writing through digital platforms has made the process accessible and affordable

The Pandemic's Lasting Impact on Young Minds

The COVID-19 pandemic served as a wake-up call for Indian millennials and Gen-Z professionals. The uncertainty of life became real when young, healthy individuals faced severe illness, leading to what experts call a "mortality reality check."[4]

Mumbai-based legal firms report that families now want their children in their late 20s and 30s to create wills too – a practice previously reserved for parents and grandparents. This age-agnostic approach to estate planning reflects a fundamental shift in how young Indians perceive life's uncertainties.[4]

Digital Revolution: Online Will Writing India Takes Center Stage

The Rise of Digital Will Maker Platforms

The traditional approach of visiting lawyers and paying ₹10,000-15,000 for basic will drafting has given way to sophisticated online platforms that offer comprehensive solutions at fraction of the cost.[5]

Leading Online Will Writing Platforms in India:[6]

| Platform | Basic Price | Legal Support | Key Features |

|---|---|---|---|

| Yellow | ₹1,499-2,499 | 2 video consultations with experts | Government-recognized, 12-month updates |

| WillJini | ₹2,999+ | In-house legal guidance team | Banking partnerships, 60-day completion |

| AasaanWill | ₹4,999-29,999 | Expert consultation included | Notarization/registration services |

| EzeeWill | ₹4,000 | 2 free legal reviews | NSDL partnership, doorstep service |

| eSahayak | ₹349 (50% off) | Paid consultation (₹3,500) | Most affordable option, 60-day changes |

Why Young Professionals Choose Digital Solutions

Convenience Factor: One can now make a legally valid will from the comfort of their home, eliminating the traditional barriers of time-consuming lawyer visits and complex documentation.[2][1]

Affordability Revolution: Where experienced lawyers charge ₹10,000-15,000, online platforms offer comprehensive solutions starting at ₹349, making will writing accessible to middle-class families.[5]

Tech-Savvy Adoption: Millennials and Gen-Z professionals, already comfortable with digital financial services, naturally gravitate toward online estate planning solutions that integrate seamlessly with their digital lifestyle.

The Wealth Creation-Legacy Protection Cycle

New-Age Wealth, New-Age Solutions

Several youngsters have acquired large wealth from new-age businesses, digital businesses, sale of such businesses or assets, creating unprecedented wealth accumulation patterns among young professionals.[1][2]

Key wealth creation drivers:[7][1]

- 41% of millennials prioritize homeownership as their primary long-term goal

- 21% want to start or expand their own business, creating substantial asset bases early in life

- Digital business exits and IPOs have created millionaires in their 20s and 30s

- Fintech adoption at 87% has democratized investment opportunities

The Psychology Behind Early Estate Planning

"Why do I need a will at 30?" – this traditional response has been replaced by proactive planning among young professionals. The shift represents a fundamental change in risk perception and responsibility.[4]

Modern motivations include:[1]

- Protecting accumulated wealth from new-age businesses and investments

- Ensuring disciplined wealth deployment for family security

- Creating "giving back" contributions while building personal legacy

- Safeguarding inheritance for the next generation despite young age

Will Registration: The Legal Framework Revolution

Understanding Will Registration in India

While will registration is not mandatory in India, the process has been significantly streamlined to encourage young professionals to formalize their estate planning.[8][9]

State-wise Registration Costs (2025):[5]

| State | Registration Fee | State | Registration Fee |

|---|---|---|---|

| Delhi | ₹600 | Mumbai (Maharashtra) | ₹100 |

| Karnataka | ₹20 | Tamil Nadu | ₹100 |

| Gujarat | ₹20 | Uttar Pradesh | ₹10 |

| Haryana | ₹10 | West Bengal | ₹10 |

| Punjab | ₹15 | Bihar | ₹100 |

The Simplified Registration Process

New 2025 streamlined process:[9][8]

- No stamp duty required for will registration

- Minimal registration fees ranging from ₹10-600 across states

- Testator plus two witnesses required during presentation

- 15-day standard processing time across most states

- Online initiation available in select states with physical completion

Success Stories: Young Professionals Taking Control

The Tech Entrepreneur's Wake-Up Call

Background: A 34-year-old tech entrepreneur in Bangalore with a successful exit worth ₹15 crore

Trigger: COVID-19 hospitalization in 2021 made him realize his family's financial vulnerability

Action: Used Yellow's Pro Plan (₹2,499) to create a comprehensive will covering:

- Startup equity distributions

- Real estate assets (₹3.5 crore home)

- Investment portfolio (₹8 crore across mutual funds and stocks)

- Digital asset inheritance for crypto holdings

Outcome: Complete peace of mind with yearly updates to reflect changing asset values

The Working Mother's Digital Legacy

Background: A 38-year-old marketing director in Mumbai, single mother with one child

Challenge: Wanted to ensure her 8-year-old daughter's financial security

Solution: WillJini's Standard Plan with bank partnership benefits

- Appointed her sister as executor and child's guardian

- Created education trust fund from insurance proceeds

- Included provisions for daughter's higher education abroad

Impact: Integrated will planning with existing financial planning through HDFC Bank partnership

The NRI Professional's Cross-Border Planning

Background: A 35-year-old software architect working in Silicon Valley with significant Indian assets

Complexity: Assets spread across India (₹2.5 crore property in Delhi) and US (401k, stocks)

Platform Choice: AasaanWill's Premium Service (₹29,999) for complex international planning

- Separate wills for Indian and US assets

- Tax-efficient transfer structures

- NRI-specific legal compliance

Result: Comprehensive cross-border estate plan ensuring smooth asset transfer

The Business Impact: Industry Growth Explosion

Market Size and Growth Projections

The online will writing service market is experiencing unprecedented growth in India:[10][11]

- Market size growing at XX% CAGR through 2025

- Shift from offline to online: 70% of new will queries now start digitally

- Geographic expansion: Services now available in tier-2 and tier-3 cities

- Language democratization: Platforms offering services in Hindi, Tamil, and regional languages

Banking Partnerships Drive Adoption

Wealth and succession managers are tying up with banks to drive awareness among younger populations. Major partnerships include:[2][1]

- HDFC Bank x WillJini: Integrated wealth management services

- ICICI Bank x Yellow: Complete estate planning solutions

- SBI x Multiple Platforms: Reaching rural and semi-urban customers

Common Myths vs. Reality: Young Professional Edition

Myth 1: "I'm Too Young for a Will"

Reality: Families are largely completed by age 35-40 with substantial assets in place. The first house, car, and significant savings create immediate need for estate planning.[2][1]

Myth 2: "Online Wills Aren't Legally Valid"

Reality: Online wills are completely legal in India when properly executed. The process of creation is digital, but execution requirements (signatures, witnesses) remain identical to traditional wills.[12]

Myth 3: "Will Registration is Mandatory"

Reality: Registration is optional but highly recommended. It provides additional legal protection and costs as little as ₹10 in states like Uttar Pradesh.[8][9]

Myth 4: "It's Too Complicated"

Reality: Modern platforms like Yellow can create a comprehensive will in under 30 minutes with expert guidance and legal review included.[13][14]

Step-by-Step Guide: Creating Your Online Will

Phase 1: Platform Selection and Preparation

Choose Your Platform Based on Needs:

- Budget-conscious: eSahayak (₹349) for basic requirements

- Comprehensive planning: Yellow Pro (₹2,499) with expert consultations

- Complex assets: AasaanWill Premium (₹29,999) for high-net-worth planning

Gather Required Information:

- Complete asset inventory (property, investments, bank accounts)

- Beneficiary details (names, ages, relationships)

- Executor selection (trusted person to implement your wishes)

- Guardian nominations for minor children

Phase 2: Digital Will Creation Process

Step 1: Registration and Verification

- Create account with chosen platform

- Complete KYC verification process

- Select appropriate plan based on complexity

Step 2: Asset Documentation

- Property Details: Address, ownership documents, current values

- Financial Assets: Bank accounts, investments, insurance policies

- Digital Assets: Email accounts, social media, crypto wallets

- Personal Items: Jewelry, vehicles, sentimental possessions

Step 3: Beneficiary and Distribution Planning

- Specify exact percentage distributions

- Name alternate beneficiaries for contingencies

- Include specific bequests for personal items

- Address potential disputes proactively

Phase 3: Legal Validation and Registration

Review and Finalization:

- Platform legal review (2-3 iterations typically included)

- Expert consultation calls (Pro plans include 1-2 sessions)

- Final document generation in legally compliant format

Optional Registration Process:

- Download final will document

- Visit local sub-registrar office with two witnesses

- Pay nominal registration fee (₹10-600 depending on state)

- Receive registered will certificate

The Future of Estate Planning in India

Emerging Trends Shaping Young Professional Adoption

Integration with Financial Planning: Estate planning is becoming integrated with comprehensive financial planning, with platforms offering holistic wealth management solutions.

AI-Powered Recommendations: Next-generation platforms are incorporating AI to suggest optimal asset distribution strategies based on family circumstances.

Blockchain Validation: Emerging technologies promise tamper-proof will storage and validation, appealing to tech-savvy millennials.

Cross-Border Solutions: As more Indians work globally, platforms are developing sophisticated international estate planning capabilities.

Government Initiatives Supporting Digital Adoption

Yellow is the only estate planning company recognized by the Ministry of Social Justice and Empowerment under the SAGE initiative, indicating government support for digital estate planning solutions.[14]

The recognition specifically targets senior citizens but validates the digital approach to estate planning, encouraging broader adoption across age groups.

Critical Considerations for Young Professionals

Asset Protection vs. Estate Planning

For young entrepreneurs and business owners, estate planning intersects critically with asset protection. The Supreme Court's recent ruling on personal guarantees means business risks can extend to personal assets, making sophisticated estate planning essential.[4]

Key protective strategies:

- Segregate personal assets from business risks through proper legal structures

- Consider asset protection trusts for high-risk business ventures

- Regular will updates to reflect changing business circumstances

Life Stage Considerations

Pre-Marriage Planning: Young professionals should create initial wills covering current assets and update them after marriage.

Post-Marriage Updates: Joint asset planning, spouse beneficiary designations, and coordinated estate strategies.

Children Arrival: Guardian nominations, education fund planning, and long-term family security structures.

Career Growth: Regular updates reflecting increasing asset values, stock options, and business interests.

Tax Implications and Optimization

Current Tax Landscape for Young Inheritors

India currently has no inheritance tax, making will planning primarily about asset distribution rather than tax minimization. However, young professionals should consider:[15]

Income Tax on Inherited Assets: While inheritance itself isn't taxed, income from inherited assets is taxable in the hands of beneficiaries.

Capital Gains Implications: Strategic timing of asset transfers can optimize capital gains treatment for beneficiaries.

Future Tax Planning: With discussions about potential inheritance tax introduction, early planning provides flexibility for future optimization.

Taking Action: Your Estate Planning Roadmap

Immediate Steps (This Week)

- Asset Inventory: Create comprehensive list of all current assets, however small

- Platform Research: Compare top 3 platforms based on your specific needs and budget

- Beneficiary Decisions: Identify primary and alternate beneficiaries for each asset category

- Executor Selection: Choose trusted person capable of handling financial and legal responsibilities

Month 1: Foundation Building

- Complete platform registration and choose appropriate service level

- Draft initial will covering current assets and basic distribution wishes

- Expert consultation (if included in chosen plan) to review and optimize structure

- Document finalization with all required signatures and witness attestation

Ongoing Maintenance (Annual Review)

Life Events Requiring Updates:

- Marriage or divorce

- Birth of children

- Major asset acquisitions

- Career changes or business ventures

- Beneficiary status changes

Market-Driven Reviews:

- Significant asset value changes

- New investment categories

- International relocation

- Business expansion or exit

The Bottom Line: Why Young Professionals Can't Wait

The statistics are clear: 40% of will writing queries now come from people under 40 because young professionals recognize that estate planning isn't about age – it's about responsibility.[1][2]

With mortality rates in the 25-44 age group increased by 30% and families typically complete their core structure by age 35-40, the traditional approach of "waiting until retirement" for estate planning has become obsolete.[2][1]

The digital revolution has removed all barriers:

- Costs as low as ₹349 make will writing accessible to every working professional

- Online platforms eliminate time constraints with 24/7 availability

- Expert guidance ensures legal compliance without expensive lawyer consultations

- Regular updates accommodate life changes seamlessly

Your family's security shouldn't depend on chance. In an era where young professionals are building substantial wealth through digital businesses, stock options, real estate investments, and entrepreneurial ventures, comprehensive estate planning has become a fundamental responsibility.

The platforms exist, the costs are minimal, and the process is straightforward. The only question remaining is: Will you be part of the 40% taking control of their legacy, or will you leave your family's future to uncertainty?

Start your estate planning journey today with India's leading online will writing platforms – because in a world of digital wealth and modern families, traditional approaches to legacy planning simply aren't enough.

This analysis is based on current market trends and platform offerings as of September 2025. Always consult with qualified legal professionals for complex estate planning needs.

[1] (https://sngpartners.in/outside_perspective/wealthy-wise-the-surging-trend-of-will-writing-among-indian-young-professionals/)

[2] (https://economictimes.com/news/india/wealthy-wise-the-surging-trend-of-will-writing-among-indian-young-professionals/articleshow/106167071.cms)

[3] (https://edtimes.in/why-are-young-indian-professionals-writing-their-wills/)

[4] (https://timesofindia.indiatimes.com/business/india-business/rush-for-wills-to-secure-family-wealth-in-covid/articleshow/83414965.cms)

[5] (https://esahayak.io/blog/cost-of-making-a-will-in-india-state-wise)

[6] (https://my-legacy.ai/top-online-will-makers-in-india2024-compare-prices-and-features/)

[7] (https://www.outlookmoney.com/news/indian-millennials-see-financial-independence-among-key-long-term-goals-report)

[8] (https://revenue.delhi.gov.in/revenue/property-registration)

[9] (https://www.registerkaro.in/post/will-registration-in-india)

[10] (https://www.archivemarketresearch.com/reports/online-will-writing-service-53892)

[11] (https://www.verifiedmarketreports.com/product/online-will-writing-service-market/)

[12] (https://www.edrafter.in/make-your-will/)

[13] (https://www.getyellow.in/legal-will)

[14] (https://www.getyellow.in)

[15] (https://www.sanctumwealth.com/in-the-press/preserving-prosperity-how-indias-uhnwis-are-securing-their-future-generations)

[16] (https://www.ubisl.co.in/will-writing.aspx)

[17] (https://blog.taxrobo.in/wealth-management-strategies-millennials-boomers/)

[18] (https://innovateindia.mygov.in/yuva-2025/)

[19] (https://arkade.in/why-gen-z-millennials-are-prioritizing-homeownership-in-their-financial-plans/)

[20] (https://www.aasaanwill.com)

[21] (https://www.news18.com/business/mini-retirement-trend-grows-in-india-as-gen-z-and-millennials-seek-work-life-balance-9562483.html)

[22] (https://www.moneycontrol.com/news/business/personal-finance/why-young-indians-need-wills-12854234.html)

[23] (https://vakilsearch.com/will-registration-online-india)

[24] (https://www.moneycontrol.com/news/business/personal-finance/mini-retirements-a-growing-trend-among-indians-64-gen-z-and-58-millennials-in-favour-reveals-hsbc-survey-13535192.html)

[25] (https://economictimes.com/news/india/tragedies-spur-more-indians-to-draw-up-will/articleshow/121959979.cms)

[26] (https://www.icicidirect.com/Services/WillDrafting)

[27] (https://www.angelone.in/news/personal-finance/mini-retirement-trend-in-india-gen-z-and-millennials-redefine-work-life-balance)

[28] (https://timesofindia.indiatimes.com/city/pune/more-indians-across-age-groups-have-taken-to-writing-a-will/articleshow/75073816.cms)

[29] (https://www.willjini.com)

[30] (https://www.moneycontrol.com/news/business/personal-finance/a-comparative-analysisonline-will-services-1548235.html)

[31] (https://www.youtube.com/watch?v=3Rz4VbcM9Ck)

[32] (https://www.goodreturns.in/personal-finance/planning/online-will-or-e-will-platforms-offering-this-service-in-india-1209865.html)

[33] (https://litem.in/will-registration/)

[34] (https://www.getyellow.in/resources/yellow-indias-best-online-will-maker)

[35] (https://www.legalkart.com/legal-blog/registration-of-will-after-death-in-india)

[36] (https://www.getyellow.in/resources/estate-planning-for-young-adults-an-essential-guide)

[37] (https://www.getyellow.in/resources/the-cost-of-making-a-will-in-india-diy-vs-online-solutions)

[38] (https://www.ezylegal.in/blogs/online-will-making-and-will-registration-in-uttar-pradesh)